Broker Trends and Opportunities – November 2024

Shine a Light on the End of the Tunnel for Clients

As the UK economy digests the autumn budget, commercial finance advisors have a pivotal role in guiding property investors and trading businesses through its consequences.

The budget has brought significant changes, and with them, opportunities for advisors to support their clients in making informed decisions. This blog explores how advisors can add value to their clients, focusing on mortgage refinancing, cash flow management, and cash flow forecasting.

Navigating Mortgage Refinancing with Fluctuating Interest Rates

For property investors, fluctuating interest rates present a significant challenge. Uncertainty in the market can make mortgage refinancing daunting. By staying on top of current products and available rates, advisors can provide timely advice to help property investors secure the most suitable outcomes when refinancing.

Advisors can also help clients understand the implications of different mortgage products, whether fixed-rate, variable-rate, or tracker mortgages. By understanding the client’s financial situation and long-term investment goals, advisors can recommend the most suitable mortgage options, ensuring clients are not caught off guard by future interest rate changes.

Supporting Trading Businesses with Cash Flow and Working Capital

Trading businesses often face cash flow challenges, especially in an unpredictable economic environment. The autumn budget has introduced measures that could impact cash flow, such as increases in the National Living Wage and Employer’s National Insurance contributions.

Through commercial finance products, advisors can help secure working capital finance solutions, such as business loans, asset finance, invoice finance, or supply chain funding.

Advisors can support clients in managing growth, purchasing new equipment, or handling day-to-day overheads. They can also access facilities to spread the cost of liabilities, including VAT or Corporation Tax. Spreading HMRC debt over 3-12 months helps businesses avoid large one-off cash calls, enabling them to fund new work and meet other liabilities.

Leveraging Asset and Vehicle Finance

Asset and vehicle finance can be viable options for businesses looking to grow or upgrade equipment. Advisors can help clients understand the pros and cons of different financing options, such as leasing, hire purchase, and asset-backed loans.

Advisors can add more value by understanding their clients’ commercial drivers and growth plans.

Enhancing Cash Flow with Invoice and Supply Chain Finance

Invoice and supply chain finance can be powerful tools to help businesses improve cash flow. Brokers can inform clients how these products work and integrate them into their overall strategy. By leveraging invoice finance, businesses can unlock cash tied up in unpaid invoices, providing the working capital needed to take on new projects and grow.

Supply chain finance can help businesses optimise and, in some cases, just afford their supply chain, strengthening supplier relationships and ensuring a steady flow of goods and services, crucial for business continuity.

Planning for Cash Flow Requirements

Managing cash flow in the face of an increasing tax burden is a significant challenge for some businesses. Advisors can help clients develop proactive cash flow management strategies through suitable funding products rather than reacting when cash flow runs short. This includes creating and regularly updating detailed cash flow forecasts.

Conclusion

The role of advisors has never been more critical in supporting their clients. By providing expert guidance on mortgage refinancing, cash flow management, and cash flow forecasting, advisors can help property investors and trading businesses navigate the complexities of the UK economy post-autumn budget.

With the right support and access to commercial finance products, clients can not only survive but thrive, shining a light on the end of the tunnel and moving towards a prosperous future.

Mark Grant, Managing Director, Fiducia Commercial Network.

November 2024.

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

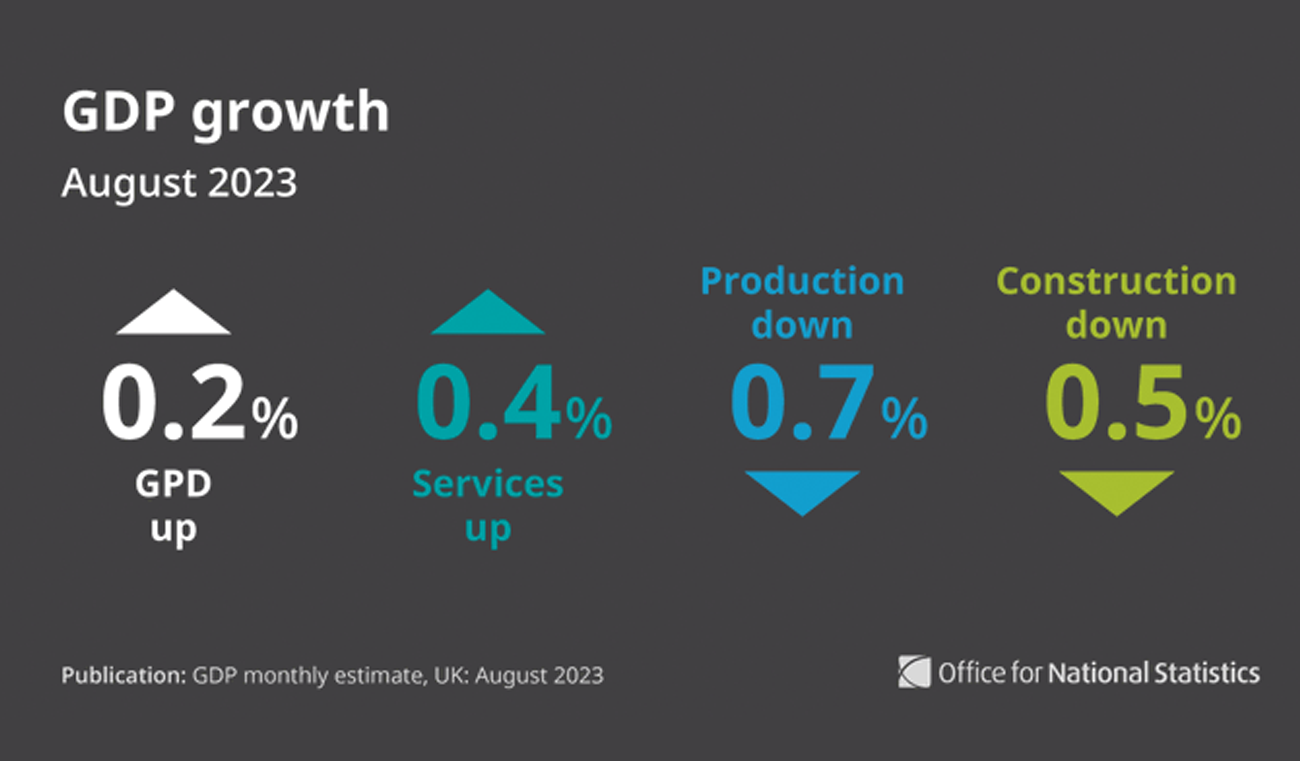

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Fiducia Commercial Network

Announce Kalon Commercial Contract Extension Fiducia Commercial Network is delighted to announce a t

Fiducia Commercial Network

Following a successful end to 2023, where the network team experienced rapid expansion, the commerci