Lifting Your Business to the Next Level

By IAN COULSON, Head of Commercial Brokerage, HSBC UK

When you’re looking to open new doors for your clients, it makes sense to forge links with a known and trusted partner – one that offers the widest possible range of products and solutions.

HSBC UK serves over 15 million active customers which includes 685,000 businesses across the UK, supported by 23,900 colleagues. We partner with businesses from small and medium sized enterprises to large corporates – supporting every stage of their growth, their international ambitions and their sustainability transitions – through our universal banking capabilities

We don’t coast on those credentials, however. They are matched by an unparalleled level of care in the way we build relationships with you and your clients.

We support brokers and introducers operating right across the commercial lending space. As a member of our Broker Panel, you’ll benefit from specialised support from our dedicated team, who will cultivate your relationship with the bank and support you to broaden your client relationships.

You’ll earn commission on a wide range of products, including commercial mortgage and business loans, flexible business loans, overdrafts for agriculture customers, trade loans, invoice finance, and revolving credit facilities.

Plugging into our network also gives you extra insight. Get the latest UK economic data from our Global Research team, as well as thought leadership to inform your business decisions – keeping you up to date with the latest news and key events in the UK brokerage market.

For your customers, the potential benefits are extensive. Every customer you bring on board will be allocated a dedicated relationship manager, who’ll support them on their business journey.

Together with my deputy, Chris Millage, I was instrumental in forming HSBC’s commercial brokerage proposition. We remain energised by forging relationships with brokers to help businesses grow.

And to support our network of commercial brokers we are investing in our teams. This year our team will expand with a further 10 business development managers, providing more capability to support brokers than ever before. Elena McLoughlin, one of our new business development managers, will be the point of contact for the whole Fiducia Network.

To find out more about how we could support your growth visit HSBC UK Commercial Brokers.

About HSBC UK

HSBC UK serves over 15 million active customers across the UK, supported by 23,800 colleagues. HSBC UK offers a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates. HSBC UK is a ring-fenced bank and wholly-owned subsidiary of HSBC Holdings plc. HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 57 countries and territories. With assets of US$3,214bn at 30 June 2025, HSBC is one of the world’s largest banking and financial services organisations.

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

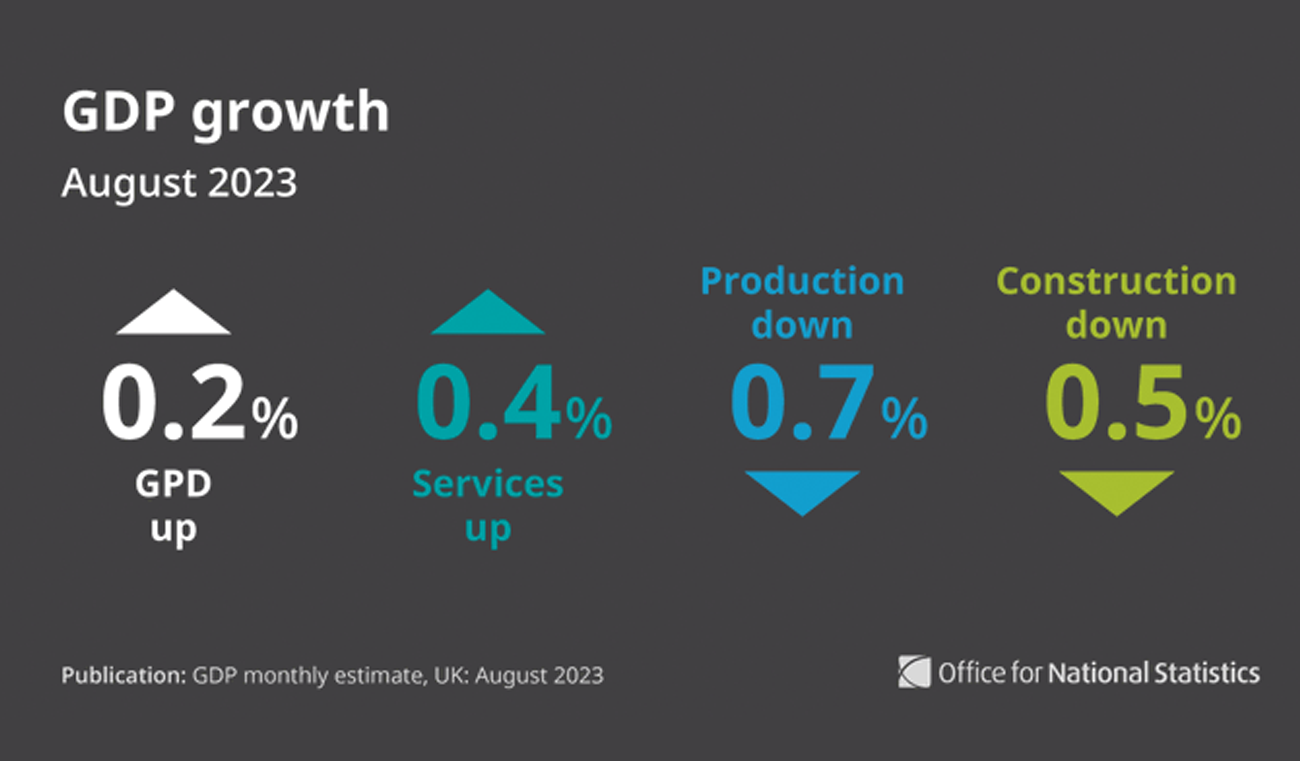

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Fiducia Commercial Network

Announce Kalon Commercial Contract Extension Fiducia Commercial Network is delighted to announce a t

Commercial Mortgages – turning a corner into 2024?

Both the economy and the commercial mortgage market appear to have reached a level where lenders hav