Preparing for the Autumn Budget: What it Could Mean for Specialist Finance

With the Autumn Budget just days away, the property finance landscape is bracing for potential upheaval. For brokers, this creates both uncertainty and opportunity and your clients need guidance on how to navigate what comes next.

What's Being Speculated

While nothing is confirmed, the Treasury is reportedly considering reforms that could fundamentally reshape property investment economics:

- Taxation and Stamp Duty. Landlords are contributing more stamp duty than before; recent HMRC data reveals stamp duty receipts surged 24% to £14.9bn in the last 12 months to October 2025. A freeze or cut to SDLT could boost transaction volumes further but if the Chancellor holds firm, brokers may see activity becoming a lot more sluggish.

- Support for SME Investors and Developers. Refurbishment and conversion remain key drivers of bridging demand. Incentives for SME investment could fuel activity, while a lack of them may keep borrowers reliant on short-term funding. Either way, alternative lending will be critical.

- Infrastructure and Regional Spending. Announcements on transport and regeneration will shape hotspots of investment. Where capital flows, finance follows and bridging is often the fastest route for investors to take advantage.

- Interest Rate and Inflation Outlook. With borrowing costs already high, any OBR forecasts suggesting rates remain higher for longer could keep traditional lenders on the back foot making short-term, unregulated business lending even more relevant.

How Bridging Finance Can Help

In times of uncertainty, flexibility becomes essential. Bridging finance offers landlords and investors the speed and agility they need to keep deals moving—whether they’re racing to complete before tax changes take effect or capitalizing on new incentives announced in the Budget.

The Autumn Budget will reveal whether these proposals become reality, but one thing is certain: brokers who understand how bridging finance works will be best positioned to guide their clients through any outcome. Whether the market accelerates or stalls, having fast, property-backed finance in your toolkit ensures you can respond quickly and keep opportunities alive.

Somo is committed to supporting property professionals through whatever comes next. Our bridging loans are designed to offer the flexibility, speed and reliability your clients may need—no matter what the Chancellor announces.

Have a bridging enquiry? Find your local relationship director at somo.co.uk, call 0161 312 5656, or email brokers@somo.co.uk.

About Somo

Somo is a specialist bridging lender with over a decade of experience in providing bridging finance solutions. We specialise in First, Second and Equitable Charge loans and we offer a wide range of products tailored to fit the diverse needs of borrowers.

We’re constantly finding better ways of bridging by asking – why make bridging difficult? So whether you’re an expert or new to bridging, we make the process clear, fast, and hassle-free.

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

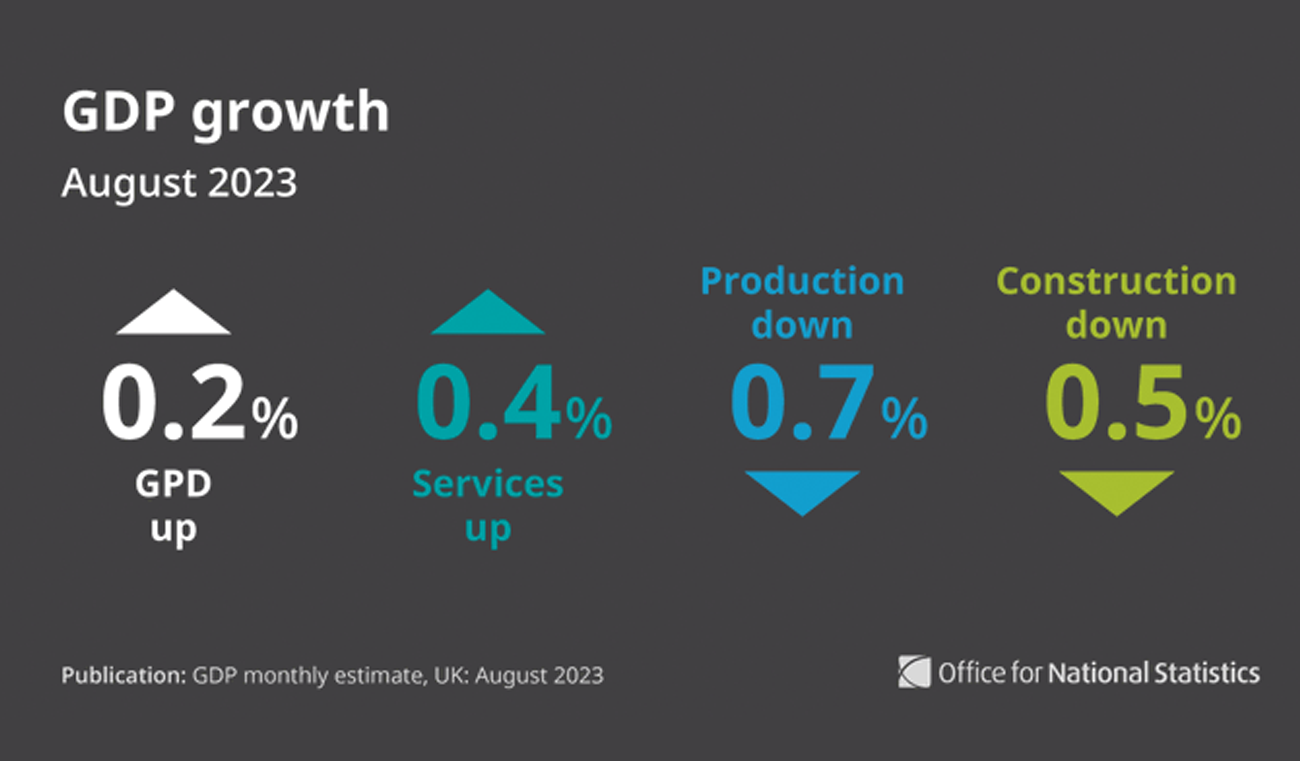

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Unlocking Capital: The Role of Second Charge Loans in Business Growth and Cash Flow Management

Unlock business growth with second charge loans. Access equity fast, maintain mortgage terms, and ex

Bridge to Let: Get the Lendco Lowdown on HMO Conversions

Lendco bridging finance supports HMO conversions with fast funding, flexible terms, and seamless ref