Turn Summer Slowdown Into Opportunities

Broker Trends and Opportunities - August 2025

Summer months for Commercial Finance brokers are often very challenging, not least the month of August. Is it me, or is everyone away on holiday!

The UK Economic Landscape: Caution and Opportunity

The current economic landscape also presents a mix of challenges and opportunities for us all in helping our SME clients. Understanding the latest economic trends is also crucial for providing effective financial solutions.

We all know that the UK economy has been navigating a period of slower growth, against a backdrop of tighter credit conditions and ongoing political and global uncertainty.

What SMEs Still Need from Brokers

However, the constant that remains unchanged is that many SMEs still require finance, be it for working capital or for growth.

Lending Market Outlook: Base Rate and Funding Options

I do, though, see the lending environment improving; many funders on our panel have tweaked their rates following a most welcome reduction in base rate to 4%.

Personally, I’m not sure if the BoE rate will be sustained, and perhaps for the longer term, the norm will be between 4% & 5%.

However, I’m not a political commentator; my primary focus is to provide the best support possible for our clients.

Practical Strategies for Supporting SME Clients

Some practical implications for our commercial finance brokers to consider are:

- Emphasise cash flow-oriented solutions, including working capital facilities, invoice finance, and supply chain finance, that align with receivables and payables cycles.

- Leverage asset-backed options: equipment finance, leasing, and inventory finance to support capex and growth without overburdening cash flow.

- Consider staged and flexible facilities: facilities that can scale with revenue growth, seasonal demand, or project milestones reduce refinancing risk for SMEs.

Flexible Finance Solutions to Consider

Another area I would consider is floating-rate facilities and term loans, especially when considering refinancing and margin expectations.

How We Support Our Broker Network

For commercial finance brokers, the opportunity always lies in delivering practical, risk-aware solutions that align with clients’ cash flows, growth plans, and their goals.

As always, at FCN, we’re here to support our network members, and we’re grateful to our lenders and partners, who are just an email or phone call away to provide assistance.

Norman Chambers

Executive Relationships Director, Fiducia Commercial Network

August 2025

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

Jade Keval, Sales Director at Somo

Network members can use this exclusive window before Somo Prime launches to the wider market. To learn more, contact Somo directly on 0161 312 5656 and make the most of this early access opportunity.

Lisa Pilgrim Appointed

Fiducia Operations Manager The Fiducia Group are delighted to welcome Lisa Pilgrim to Fiducia Commer

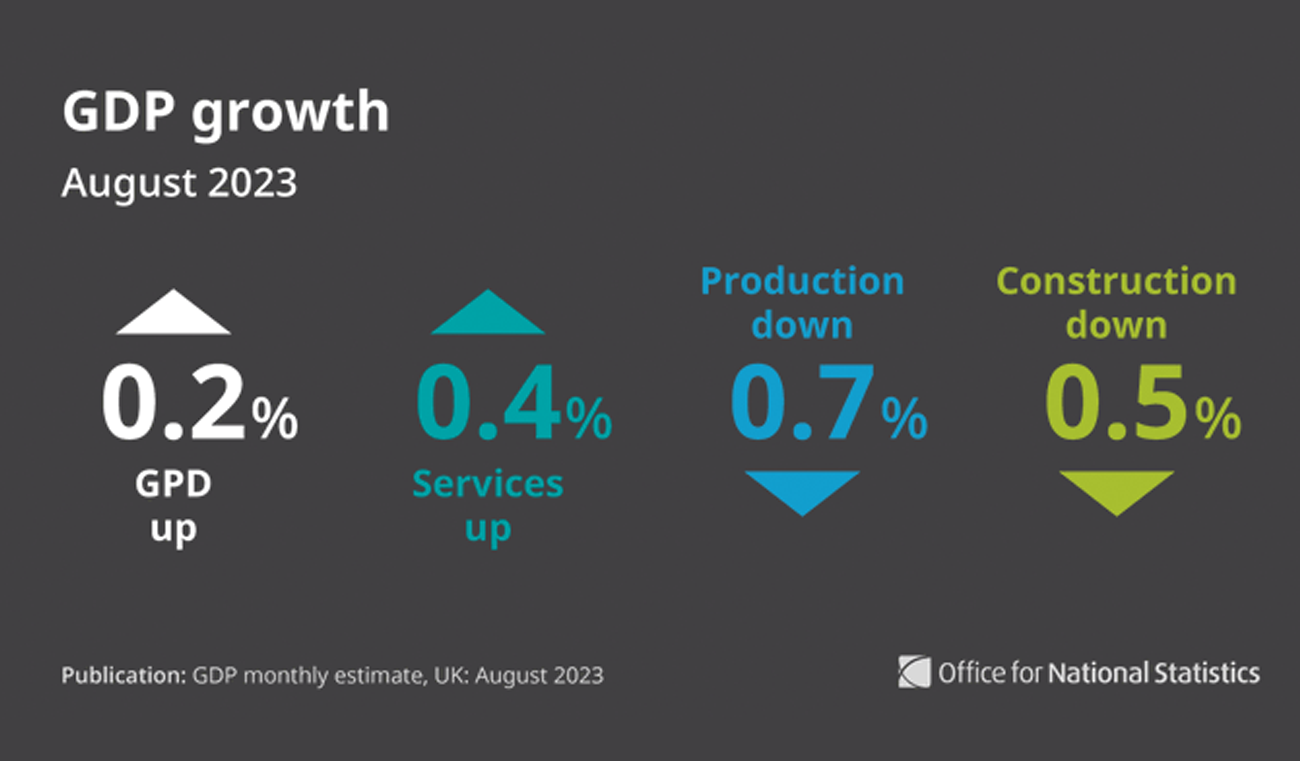

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Fiducia Commercial Network

Announce Kalon Commercial Contract Extension Fiducia Commercial Network is delighted to announce a t