Treading Water:How Brokers Can Help

Strong Businesses Stay Afloat in 2025

Broker Trends and Opportunities - July 2025

In 2025, many UK businesses are facing a frustrating paradox. On paper, they’re profitable. In practice, they’re struggling to stay afloat. These aren’t failing firms or poor credit risks. They’re well-managed, productive companies that, in a more favourable economic climate, would be thriving. But right now, they’re treading water—using significant effort just to stay where they are.

For commercial finance and mortgage brokers, this presents a clear opportunity: to step in as strategic partners and help clients navigate the financial headwinds with intuitive, timely funding solutions.

The Pressure Points

Brokers can support clients in exploring a range of options to boost portfolio performance:

- Rising employment costs: Increases in National Insurance contributions have made it more expensive to hire and retain staff. For SMEs, this hits hard.

- Persistent inflation: While the pace of inflation has slowed, prices still continue to rise. Energy, materials, and overheads continue to eat into margins and cash flow.

- Weakening demand: Even businesses that have passed on some costs to customers are seeing demand soften under the weight of the cost-of-living crisis.

- Export challenges: Post-Brexit trade friction, customs delays, and global uncertainty are making international trade more complex and costly.

Cash Flow Is King

In this environment, cash flow management is no longer just good practice—it’s a survival skill. Many businesses are facing significant time gaps between costs and income. Whether it’s paying VAT, purchasing materials, or covering payroll, the upfront costs of doing business are rising.

Take construction firms, for example. They often need to fund materials and subcontractors weeks before receiving payment. Without access to working capital, they’re forced to delay or decline projects—limiting growth and productivity.

The Broker’s Role in Strategic Portfolio Planning

This is where brokers can make a real difference. The funding needs of 2025 are not about aggressive expansion—they’re about stability, continuity, and resilience. And the businesses looking for support aren’t distressed—they’re creditworthy, well-run, and simply in need of breathing room.

As a broker, you can help clients unlock the right solutions:

- Property refinance unlocks equity immediately into working capital

- Short-term loans to cover tax bills or seasonal costs

- Asset finance to spread the cost of essential equipment

- Invoice finance to bridge the gap between delivery and payment

- Revolving credit facilities to manage fluctuating cash flow

These tools are no longer just growth levers—they’re lifelines. And your role is to help clients deploy them strategically, making sure they can continue to operate, retain staff, and deliver on contracts.

In short, you can help business clients to spread the cost of treading water and maintaining their current position.

A Shift in Mindset

The irony is clear: strong businesses are being penalised by an economic system that increases their costs as they succeed. But they’re not asking for handouts—they’re asking for flexibility, support, and smart funding.

As a broker, you’re uniquely positioned to provide that. By understanding the pressures your clients face and proactively offering tailored finance solutions, you can help them stay upright today—and thrive tomorrow.

Final Thought

2025 may not be a year of bold expansion for many UK firms. But it can be a year of strategic consolidation—with brokers playing a pivotal role. The businesses you support now will remember who helped them stay afloat when the tide was against them.

In a market where yield is king and flexibility is key, the brokers who think bigger today will be the ones who win tomorrow.

Mark Grant

Managing Director, Fiducia Commercial Network & Fiducia Commercial Finance

July 2025

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

Jade Keval, Sales Director at Somo

Network members can use this exclusive window before Somo Prime launches to the wider market. To learn more, contact Somo directly on 0161 312 5656 and make the most of this early access opportunity.

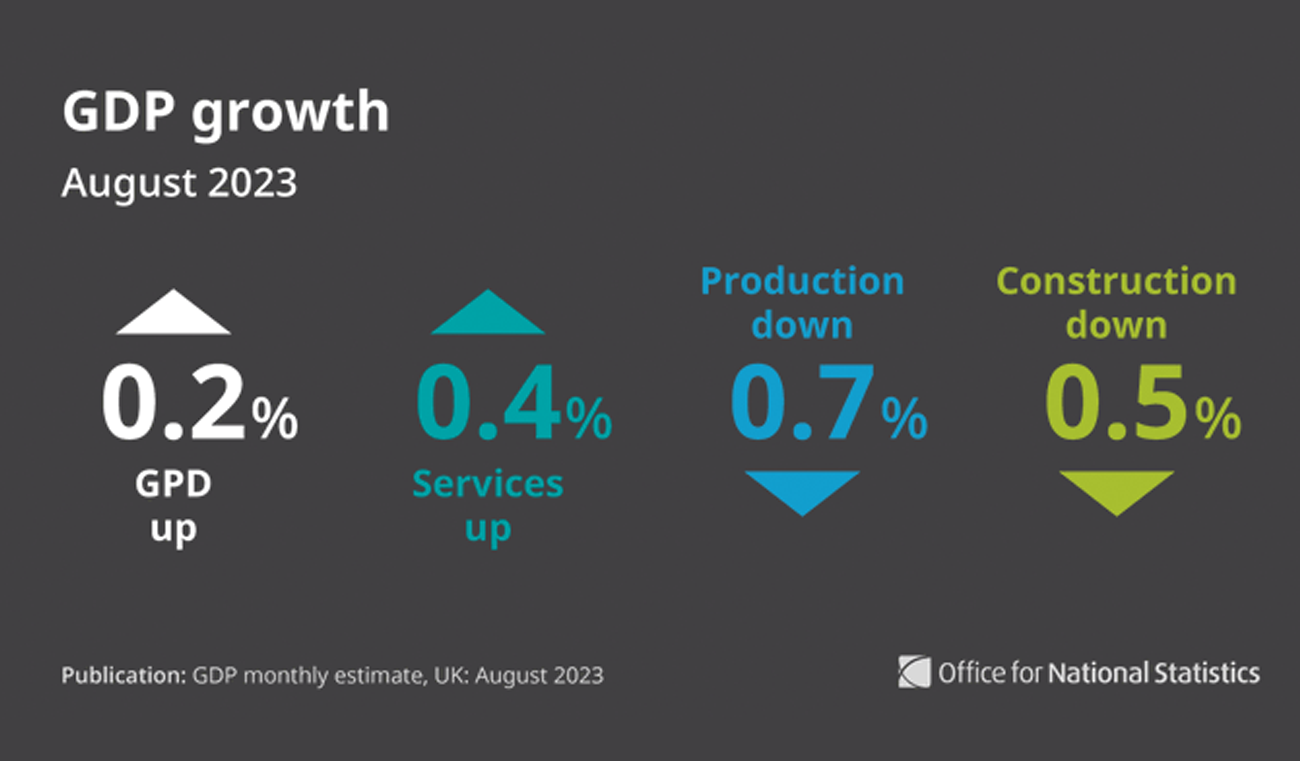

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Fiducia Commercial Network

Announce Kalon Commercial Contract Extension Fiducia Commercial Network is delighted to announce a t

Fiducia Commercial Network

Following a successful end to 2023, where the network team experienced rapid expansion, the commerci