Broker Trends and Opportunities – October 2024

Prepare With Empathy For The Autumn Budget

Advisors are all aware that the Autumn Budget 2024 is October 30th – and that given that this is the first Labour government budget for 14 years there could be some significant changes announced that could affect property investor or trading business clients.

Our role as advisors is not to have any political views on what might be contained in the budget, but there is more than one way for us to build up to the budget with clients.

The Commercial Mortgage Market

We could just wait for it to happen, and worry about the detail when it’s in the papers the next day. Probably wait for the clients to digest what it might mean to them – and then wait for them to let us know what we can do for them on the back of that assessment.

But is that not a bit transactional – and could the clients just call anyone to action what they had assessed that they need to do post-budget?

Similarly – we certainly don’t have a crystal ball – and we cannot predict with accuracy the measure that the Chancellor will announce on October 30th.

But between the two is advising clients with an understanding of their current position – of what the possible measures may be in the budget – and working with them with empathy in the build up to it so that they are prepared to make the decisions (or to not have to make them) based on what is announced on the day.

What's on the agenda?

What has been well trailed as ‘on the agenda’ for Rachel Reeves on October 30th?

- Capital Gains Tax (CGT) could be aligned with income tax levels – and if that does happen WHEN is the big question – now or April 2025, in the new tax year?

If from April 2025 will we see a stampede of landlords selling to avoid a higher CGT levy on their property holdings?

- Inheritance Tax (IHT) – could we see an IHT rate increase in the budget? If so then this does affect estate planning for landlords, especially if coupled with an increase in CGT.

- Stamp Duty Surcharge for landlords – there are housing associations and bodies calling for the removal of the Stamp Duty Surcharge for landlords to stimulate housing and accommodation at the point where this is at the top of the governments growth stimulus agenda.

Could this be considered considering the reduction in HMRC tax take it would involve?

- Energy efficiency minimum standards on properties could be raised, supported by landlord grants where the cost of improvements is prohibitive to retain some properties.

- A ‘Tax roadmap for businesses’ – for trading business clients, the government will want to support business confidence for them to invest and target growth.

With no new tax cuts or incentives for investment being trailed – could a ‘Tax roadmap for businesses’ give firms comfort that Corporation Tax will be capped at 25% for this parliament, and Full Expensing / the Annual Investment Allowance are staying?

The opportunity for the advisor to add value to customers in October is to be aware of the issues that could affect them – to be conscious of the possible actions or requirements that come when we know the facts post-budget. To prepare for the budget with empathy.

Anyone else can be a transactional broker waiting for the phone to ring on October 31st.

– Mark Grant, Managing Director, Fiducia Commercial Network. October 2024.

Fiducia Commercial Network is a commercial finance ‘Appointed Representative’ network created to allow independent firms to provide commercial property finance and trading business finance options to their existing client base and network.

Joining the network provides opportunities for professional brokers to offer a full range of commercial finance solutions by acting as an Appointed Representative (AR) with the full support of the Fiducia Commercial Network team.

The Fiducia Commercial Network membership includes FCA authorisation and reporting, PI insurance, and NACFB membership, plus business, compliance, finance, system, and admin support from a company with over 20 years’ experience in commercial finance.

If you’d like to discuss joining Fiducia Commercial Network or you’d like to apply to become an Appointed Representative…

To discuss Fiducia Commercial Network or to apply to become an Appointed Representative email the team via by clicking this link.

For all media and marketing enquiries contact – pr@fiduciagroup.co.uk

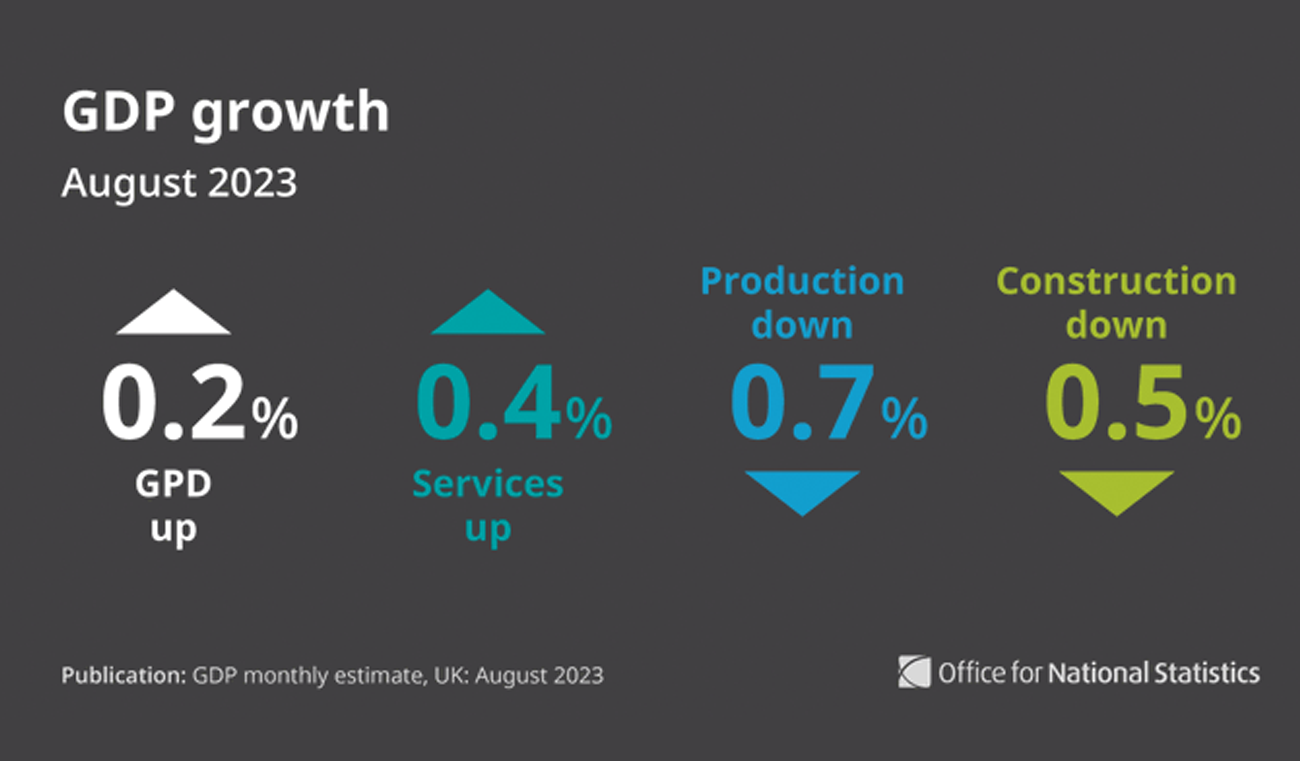

UK GDP Growth Figures Provide Confusion Not Clarity

Growth Figures released today by the Office for National Statistics provide confusion not clarity fo

Fiducia Commercial Network

Announce Kalon Commercial Contract Extension Fiducia Commercial Network is delighted to announce a t

Fiducia Commercial Network

Following a successful end to 2023, where the network team experienced rapid expansion, the commerci